Is owning a rental property in B.C. still a smart investment? It can be, with the right considerations in mind.

By Janet Gyenes

Whether it’s a luxury home on a lake or a condo close to urban amenities, snapping up real estate in one of British Columbia’s growing right-sized communities has historically been a solid long-term investment. Purchasing a rental property to secure your financial future or retirement can still be a great way to diversify your investments and income stream, while building long-term equity.

However, factor in the increased costs of financing and evolving changes to the Strata Property Act (such as regulating short-term rentals), and landlording might appear to have more short-comings than strengths these days. With these new economics and policies, is investing in a rental property still attractive?

The answers are as varied as the real estate landscape across the province. The British Columbia Real Estate Association (BCREA) reported that 2021 was a record year for sales, with seven market areas setting new highs. Now, and looking back at 2022, things have shifted significantly.

SUPPLY AND DEMAND

The Association of Interior Realtors®-Okanagan described December 2022 home sales activity in the region as “softened,” recording a 42.8 per cent decrease in the number of units sold year-over-year. Overall inventory skyrocketed 93.5 per cent at year end, with more than 6,000 units for sale.

While real estate markets are always cyclical, an increase in supply can present opportunities for would-be landlords. Location, as always, is a key consideration. Monitoring long-term trends to track population numbers is one way to assess whether a small city or region is ripe for future growth. Between 2016 and 2021, for example, two of the five fastest-growing census metropolitan areas in Canada were Kelowna (including West Kelowna, Lake Country, and Peachland) and Kamloops, increasing by 14 per cent and 10 per cent, respectively.

Recent changes to the Strata Property Act ended most rental-restriction bylaws across the province (through prohibiting short-term rentals of less than 30 days, and allowing 55-and-over seniors housing, are still allowed). Strata councils can no longer restrict the number or percentage of strata units that can be rented, for example–a move by the B.C. government to theoretically increase affordable rental housing, which remains in high demand.

Residential rental-property trends currently favour landlords, according to Canada Mortgage and Housing Commission data, with B.C. topping the list of the country’s most expensive rents. Rent for a two-bedroom purpose-built apartment averaged $1,721 in B.C. communities over 10,000 people last year, up 11 per cent from 2021. While that average is driven by the pricey Vancouver market ($2,002), Victoria ($1,669) and Kelowna ($1,690) were not far behind.

CONSIDER CASH FLOW

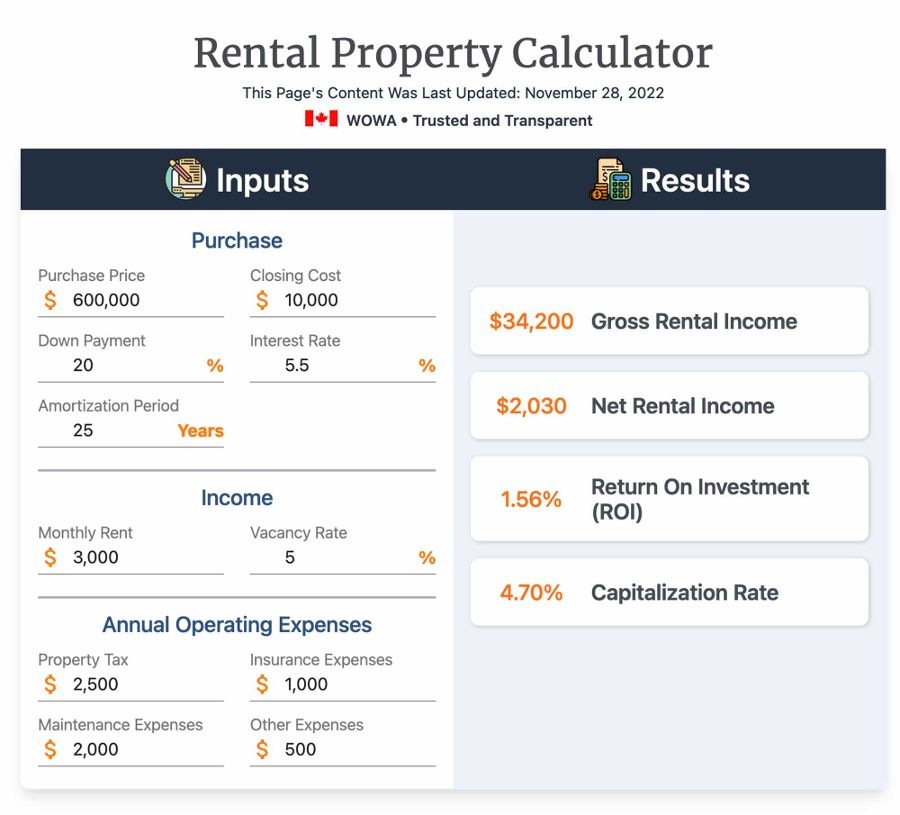

Regardless of region, whether purchasing a rental property will translate into a steady source of income still comes down to calculations. As with any investment, you need to turn down the noise that comes with market fluctuations and dial in to factors such as your investment horizon time, appetite for risk and how much you can afford, including a down payment.

One basic measure of affordability is cash flow. Subtract your total monthly expenses from the property’s gross income to get an idea of what to expect. Remember: if the roof of your rental house starts to leak after a winter storm, you’re on the hook for the repair as well as other maintenance costs. Those include property taxes, insurance and management costs (if you don’t anticipate managing renters yourself), including strata fees. If your property’s expected cash flow is negative, you might be wise to make some concessions.

You can never predict the future, but it’s smart to plan for potential scenarios. If interest rates increase, ensure you can still afford the mortgage when it comes up for renewal, even if you didn’t have to pass a so-called stress test to originally qualify. A short-term sell-off could cost you money, depending on market conditions.