What you need to know about the new Speculation and Vacancy Tax and how it affects B.C. homeowners

When the B.C. government introduced its Speculation and Vacancy Tax in the fall of 2018, the goal was to make sure homes did not sit idle during a housing shortage. While the aim was to cut down on speculation (especially from foreign investors), local owners of weekend or seasonal properties feared being caught in its crosshairs. Here’s what you need to know.

DO DECLARE

- If you own only one home and are a British Columbian, you are exempt from the tax–but you still need to declare. All homeowners in taxable areas should have received a mailed declaration code and ID for online or phone declaration.

- The annual deadline to declare an exemption from the tax is March 31. Those who don’t declare themselves exempt will be taxed.

- This year’s tax is based on ownership as of December 31, 2018 and payment is due on July 2, 2019.

- You can still complete your declaration to claim an exemption–even after you’ve received a tax notice–by emailing the government at spectaxinfo@gov.bc.ca or calling 1-833-554-2323.

WHAT’S THE RATE?

In 2018, for those who are not exempt, the tax rate is:

- 2018: 0.5% of the property’s assessed value.

- 2019 and beyond: 0.5% for Canadian citizens or permanent residents and 2% for foreign owners and what the act calls “satellite families.”

WHERE DOES IT APPLY?

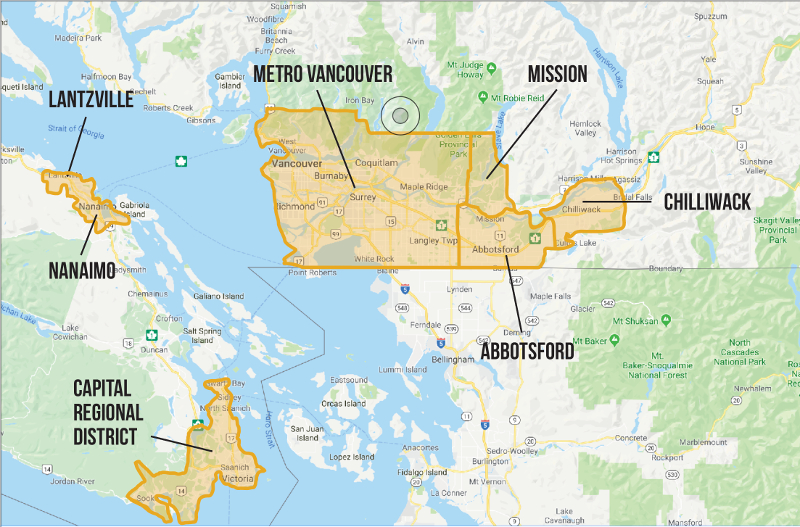

Metro Vancouver (excluding Bowen Island, the Village of Lions Bay and Electoral Area A, but including UBC and the University Endowment Lands)

Capital Regional District (Greater Victoria) (excluding Salt Spring Island, Juan de Fuca Electoral Area, and the Southern Golf Islands)

City of Abbotsford

District of Mission

City of Chilliwack

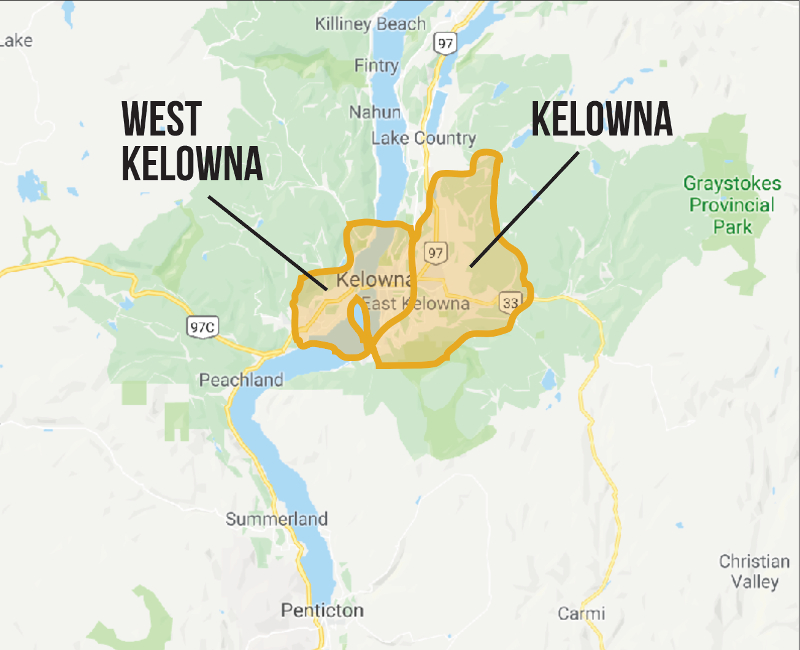

City of Kelowna

City of West Kelowna

City of Nanaimo

District of Lantzville

WHO’S EXEMPT?

The government says more than 99 per cent of all British Columbians will be exempt, including owners of a single home plus the following categories:

- Reserve lands, treaty lands and lands of self-governing indigenous Nations, plus residential properties within a taxable region that are owned by an indigenous Nation.

- Residential properties owned by municipalities, regional districts, governments and other public bodies.

- Registered charities and certain not-for-profit organizations.

- Housing co-ops.

- Islands that are acceptable only by air or water.

Beyond there, exemptions get a bit more complicated–and are open to interpretation. Study the legislation carefully and/or talk to a lawyer, but other exemptible factors include:

- If your property has become uninhabitable (damaged or destroyed by disaster; in a hazardour condition).

- If you are bankrupt.

- If you are a person with disabilities.

- If the property was just inherited.

- If it’s valued under $150,000.

- If the owner was away and it was vacant due to medical reasons, residential care, work or spousal separation.

- If the property is under construction, renovation or heritage conservation (“reasonable steps” need to be demonstrated that no “undue delays” are occuring to develop/renovate the property).

THE RENTAL KEY

- Avoid the speculation tax by renting out your property. For the 2018 tax year, owners need to rent it for three months to be exempt; for 2019 and beyond, six months is the minimum rental time.

- If you own a home in a building where the strata bans rentals, you are also exempt–at least, for 2018 and 2019. After that, strata councils are expected to change their bylaws if they want owners to avoid the speculation tax.

DO I QUALIFY FOR A TAX CREDIT?

- British Columbians with non-exempt second homes can claim a tax credit of up to $2,000 per property (covering an assessed value up to $400,000). Tax applies on the remaining value at the full rate.

- Foreign owners and satellite families can claim a tax credit equal to 20% of their B.C. income. Non-B.C. resident Canadians can access a tax credit equal to 10% of their B.C. income. In both cases, the credit cannot reduce the tax to below the 0.5% base rate.

WHERE CAN I GET MORE INFO?

The law in full: http://bclaws.ca/civix/document/id/complete/statreg/18046

Government of B.C. guidelines: https://www2.gov.bc.ca/gov/content/taxes/property-taxes/speculation-and-vacancy-tax

The declaration page: http://www.etax.gov.bc.ca/SVT/_/

BC Real Estate Association perspective: http://web.bcrea.bc.ca/ebulletin/articles/2019-01_article3.html

By Matt O’Grady